Make Compound Interest Work for You!

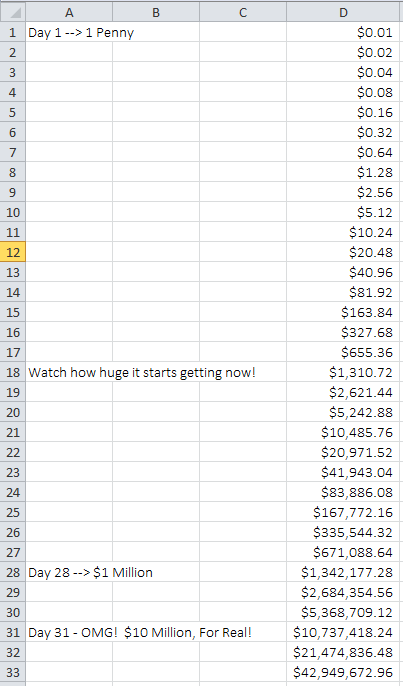

There is a calculation I saw that immediately stopped me in my tracks and raised the “doubt” flag. It says: if you doubled a penny for an entire month, you’d have over $10 million dollars by the end of day #31. Really?! No Way!

Of course, I opened an Excel spreadsheet and plugged in a few quick calculations. Here’s what it showed:

By day #18 a penny doubled is now worth $1,310.72

By day #28, we’re well over a million dollars at $1,342,177.28

And, by day #31, we’ve crossed the $10 million mark with a staggering $10,737.418.24

Hot damn! For real!

So, how can I apply this to “real” life? More importantly, how can I make this work in my own finances?

Turns out, there are two keys:

(1) Investing your money – right now!!

(2) And, let it ride for years and years and years

Here’s the secret to this miracle: We NEVER touch the principal. When we put money aside and leave it untouched to collect interest year after year, the result is nearly miraculous. You can clearly see this in the table above.

The truth is that most people don’t have a plan (nor a method) to gain access to their money while still allowing it to compound uninterrupted. This is why most people fail to accumulate substantial savings during their life. The “miracle” of compound interest works best uninterrupted and over time. If you “kill” the miracle, it doesn’t work!

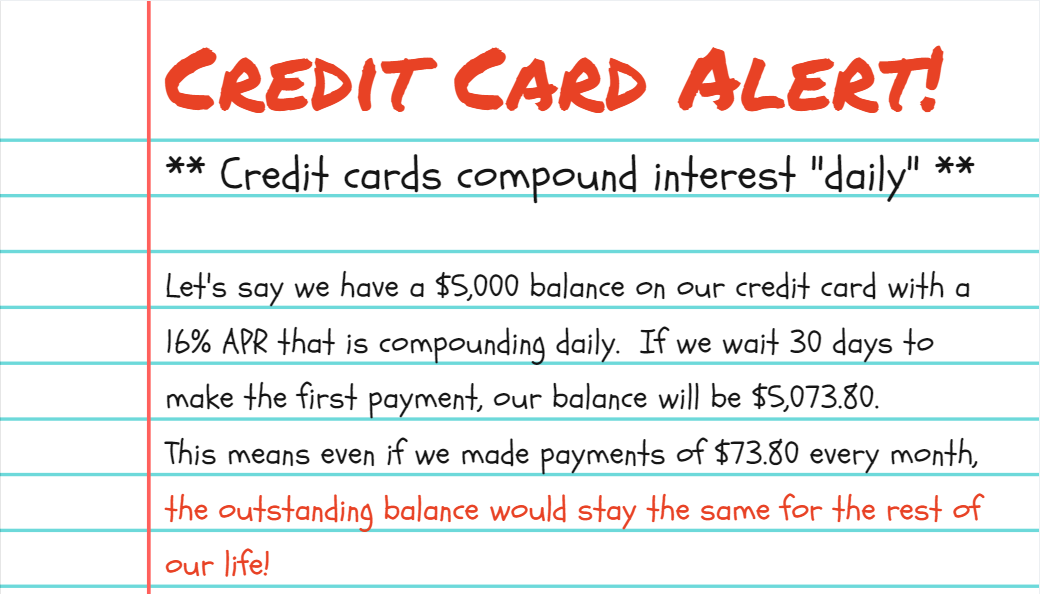

The Dark Side of Compounding Interest