Kickstart Your Debt Repayment

You’re ready to get out of debt, and we can help make that happen.

The key to managing your money is this: it needs to fit your budget and your life. When debt starts to balloon, things get out of balance and you find yourself forced to make difficult choices. There are millions of reasons why money sometimes becomes a struggle. Whatever the reason, when money does become a struggle, it has an enormous impact in almost every area of lives, making day-to-day living, planing and spending exhausting. Our “big picture” goals like owning a home, sending our kids to college or saving enough for retirement feel impossible.

Ready to start making real progress?

Basic personal finance is mostly about managing cash flow which means tracking and planning how money is entering and leaving your real and virtual pockets. Your personal cash flow statement can tell you if you are on the right path (hint: you can’t build wealth if you’re running on a deficit). Using the information provided in this form will give you an idea of how money is moving in your personal finances.

To Begin, You Will Need….

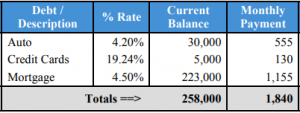

Here, we will account for your expenses. It’s useful to break down your spending into categories when doing this, as you will see below. To assist you in completing your Personal Cash Flow Statement, you will need the following: