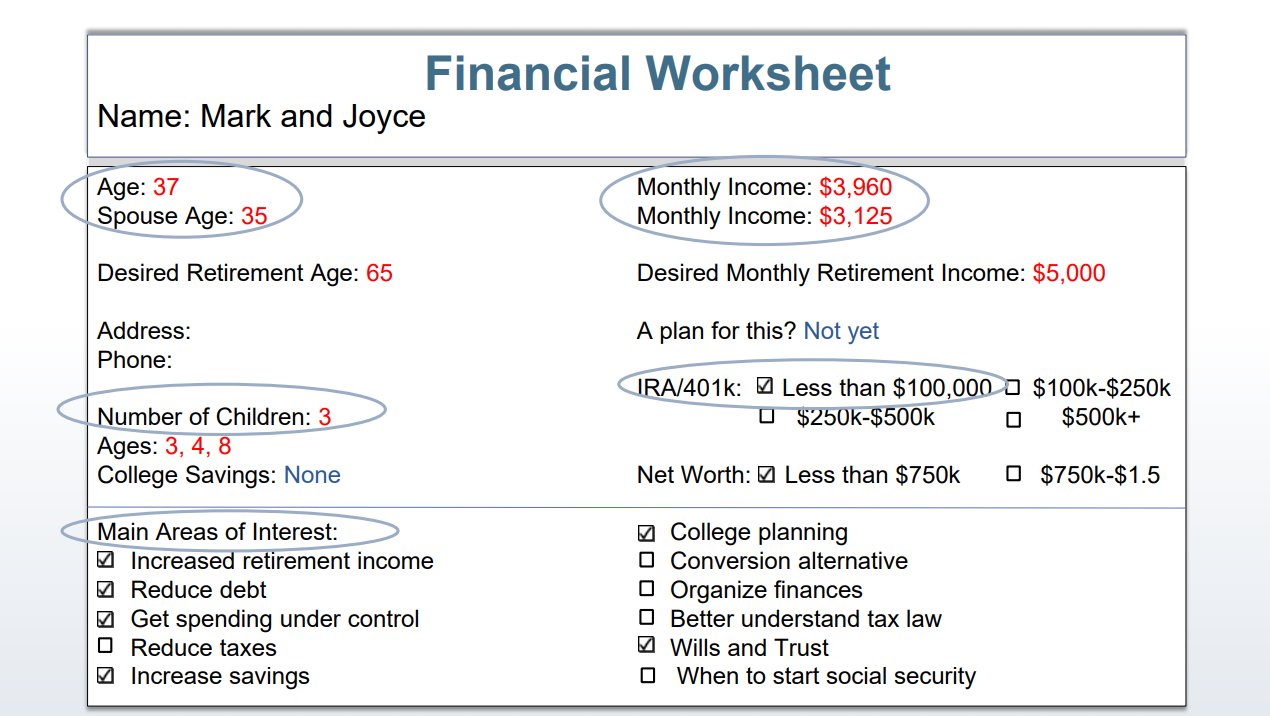

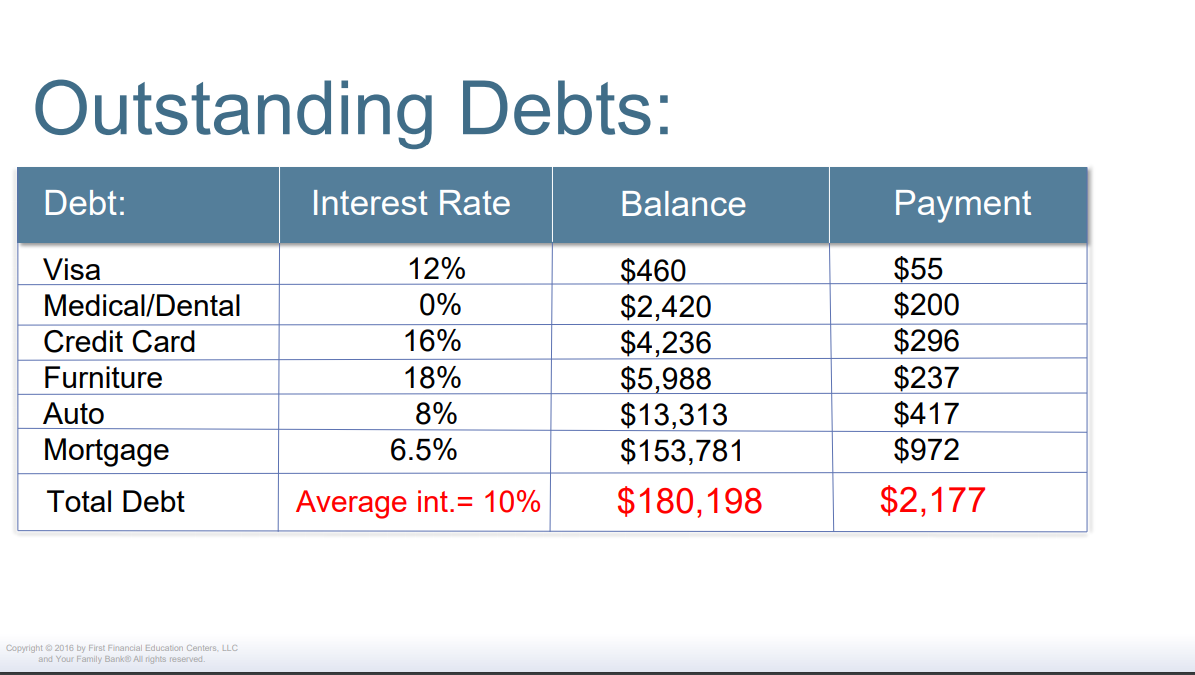

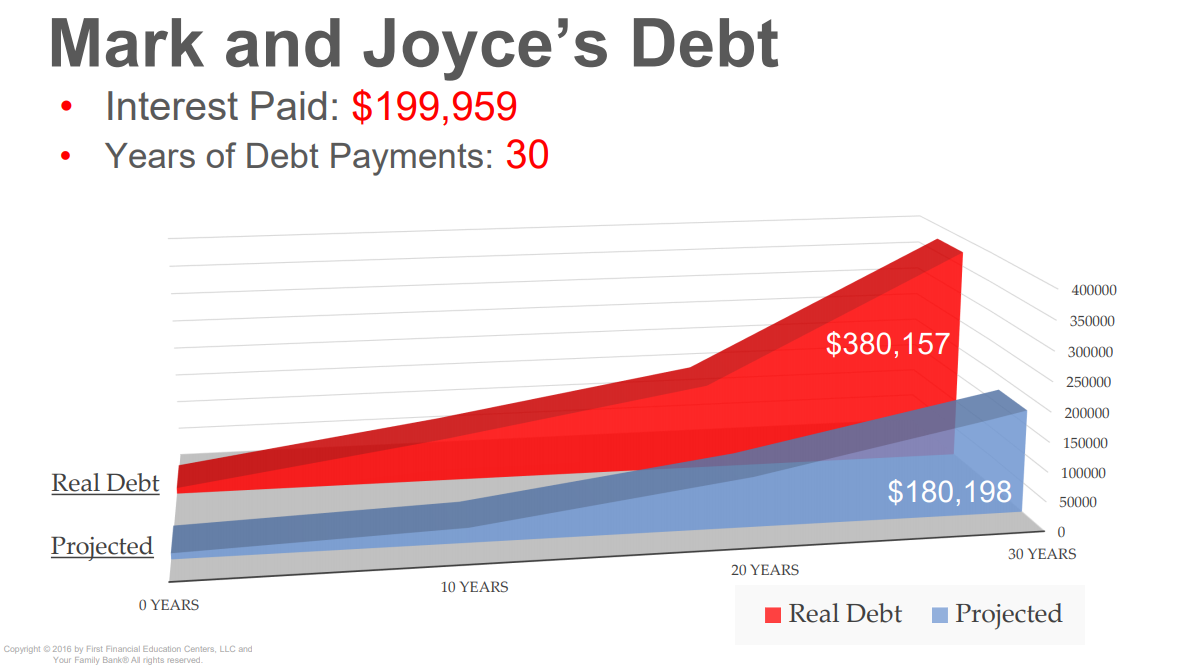

Mark & Joyce had a mortgage balance of $154,000 and personal debt over $26,000. With 3 children ages 3 to 8, the reality of college costs became a major concern for these parents.

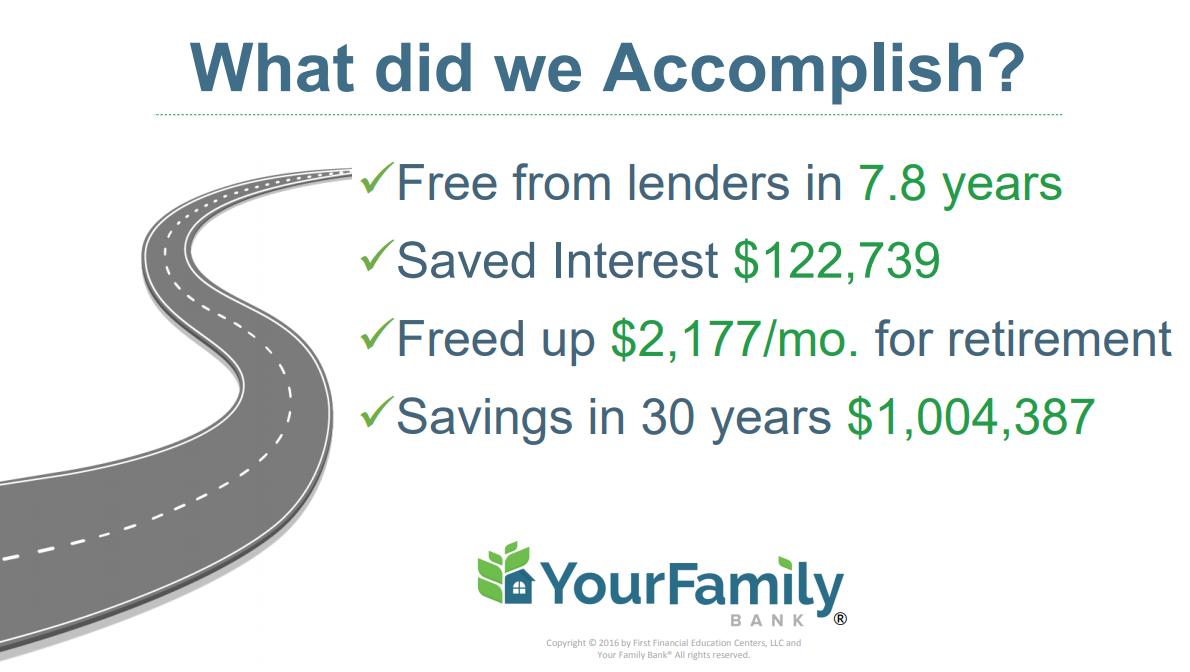

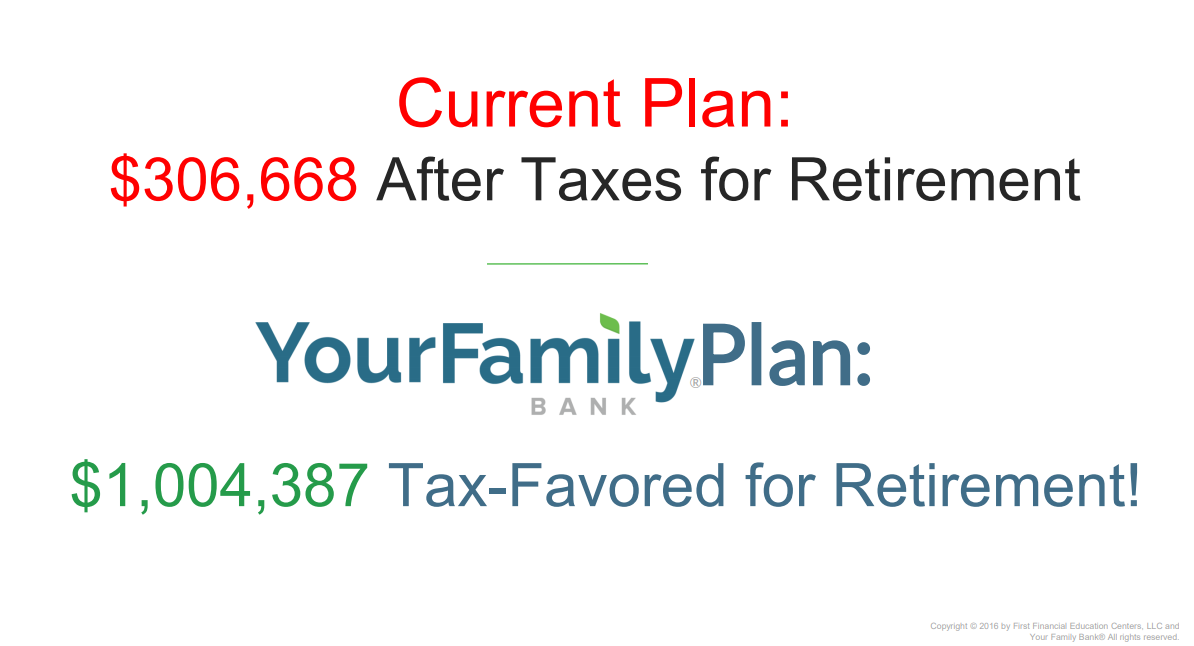

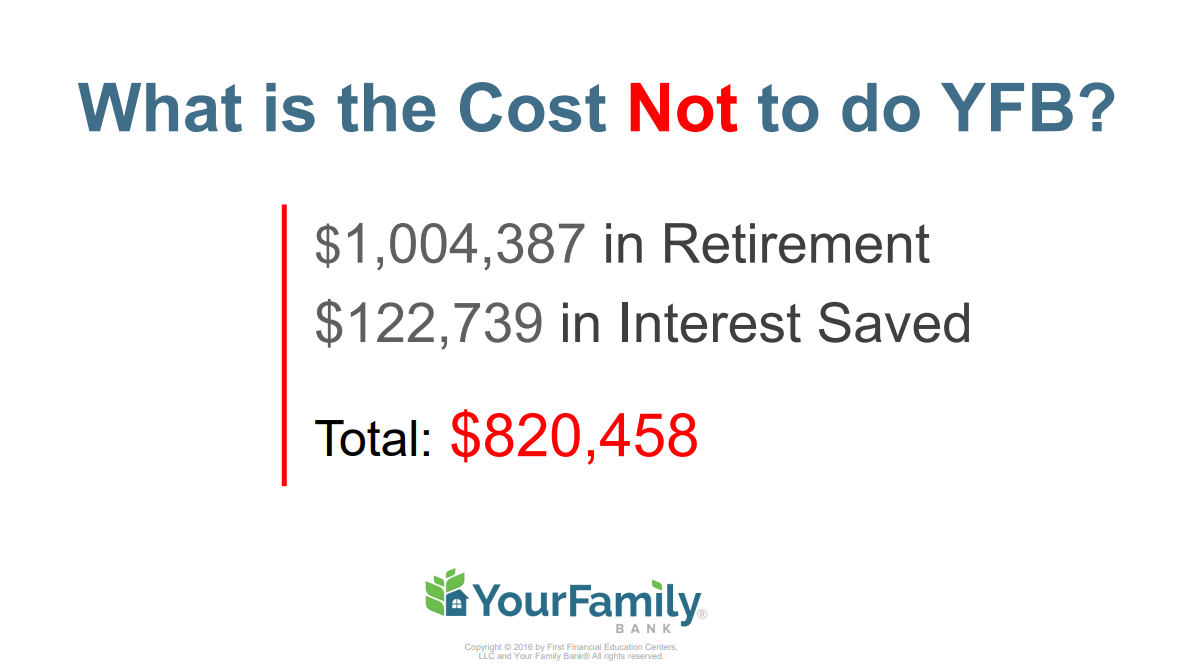

How were we able to help? The family was free from lenders in about 7-1/2 years, saving them nearly $123,000 in interest. This freed up nearly $2,200 per month which they put towards retirement and save for their children’s college education.