How Can it Help Us?

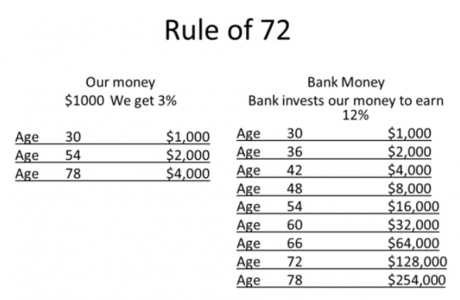

By understanding the Rule of 72, we should be able to calculate exactly what we’re getting out of our investments, as well as what we’re getting ourselves into before we open a new credit card or take out a new loan.

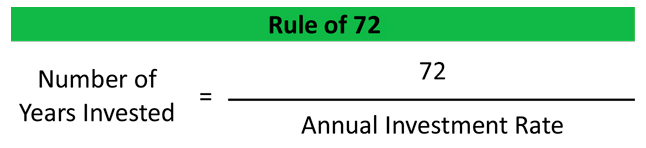

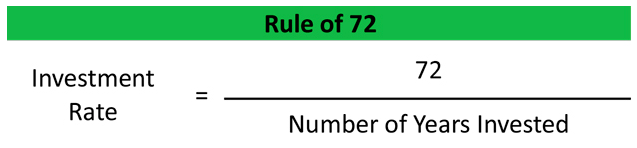

For example, if we owe a credit card company $10,000 with an 18% interest rate, our debt would double to $20,000 in four years (72/18). In eight years, our debt would be $40,000. Using the Rule rule of 72, we see our money every four years at 18% interest.

Is saving for retirement a scary thought? Use the Rule of 72 to get a ballpark number of what you’re going to need to retire. This might tell you if you need to step up your savings game.

We can also use the Rule of 72 to find out how long it will take for our money to lose half of its value because of inflation. For example, when the inflation rate goes up from 2% to 3%, our money will lose half of its value in 24 years (72/3) instead of 36 (7/3).

Now, let’s do the same bean counting backwards. Let’s assume a mutual fund charges a 3% annual expense fee. As we know, this fee will reduce the investment principal. This fee will reduce the investment principal to half in around 24 years (72/3).

In another example, let’s assume you have $1,000 in an account where you are withdrawing 12% each year. Your balance will be cut in half in approximately years (72/12).

The Underlying Force – Compound Interest

Compound interest has a snowball effect on money that you invest or borrow. It accelerates your savings. In the most simple of terms, compounding interest means earning interest on interest. This means that every time interest is paid, it is paid on an increasingly larger and larger balance. However, it can also accelerate your debts, so a firm grasp on the concept can help us avoid bad debt situations.

There you have it. The sooner you get the wonder of compounding working for you, the sooner you’ll reach your financial dreams. And, that’s exactly what we’re here to help you do!