What You Might Not Know

I get it, home ownership is important, but our house probably takes the biggest bite out of our monthly income. It can cost us literally thousands of dollars in interest over time.

Why are mortgage payments mostly interest? Here’s what you might not know. Mortgage payments are generally set up here in the U.S. so each monthly payment is the same amount. This keeps housing payments more affordable (and predictable). The balance is paid off evenly over a long period of time, say 30 years. Even though the payment is fixed, principal and interest for each month will change until the loan ends.

You Can Save Thousands in Mortgage Interest!

There is no question that the best way to buy a home is to pay cash up front. The most obvious advantage is NO mortgage, NO interest payments. Of course, it’s not that simple for the majority of us. Like it or not, a mortgage is often just a fact of life. But, it is a good idea, right? After all, mortgage rates are dirt cheap, so shouldn’t we take advantage of them? Absolutely! But, we can get the best of both worlds.

Let’s run some numbers and I’ll show you how.

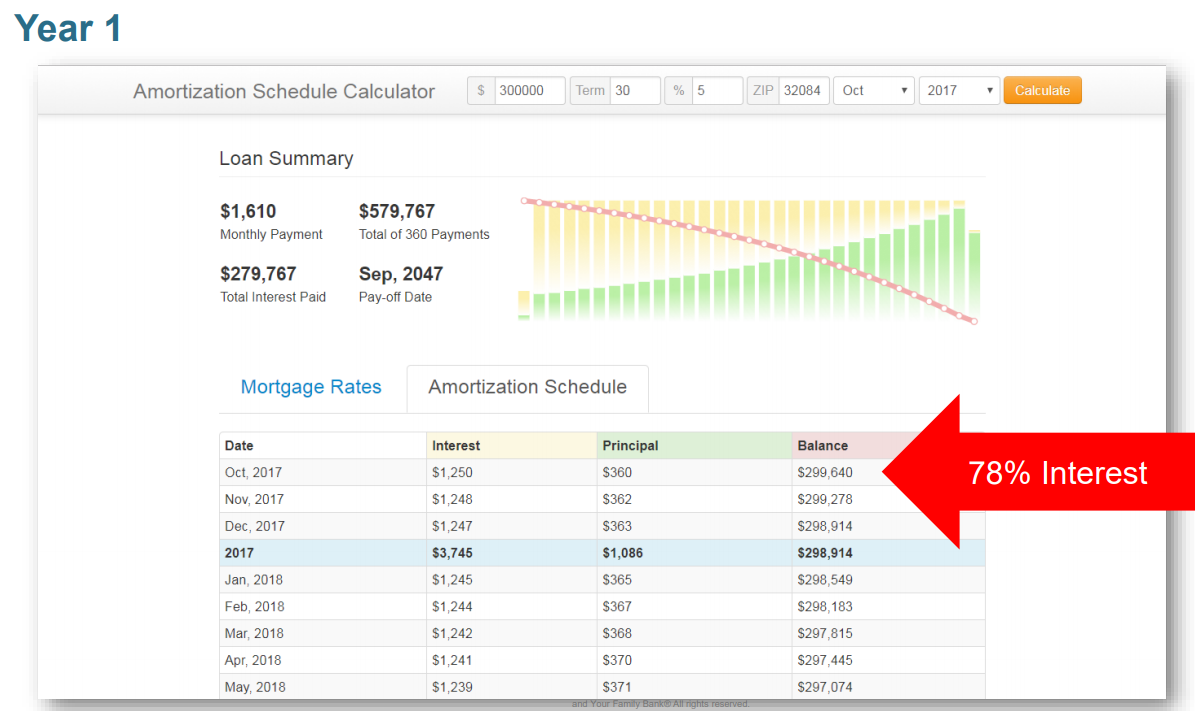

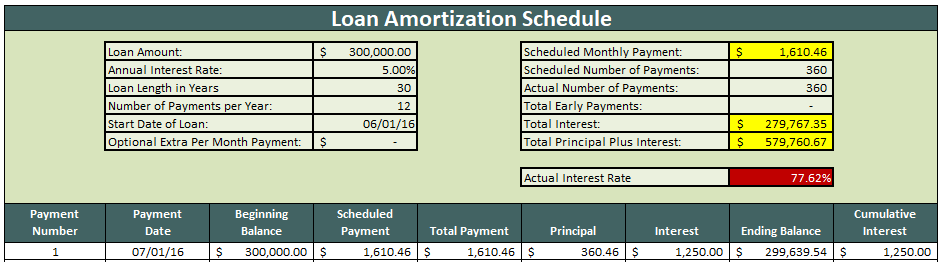

Assuming three years ago you got a 30-year $300,000 mortgage with a 5% interest rate and a monthly payment of about $1,610.46 (excluding taxes and insurance). Over the next 30 years, you’ll pay over $579,760 in principal and interest. The total amount of interest due over 30 years is close to $1279,770. The #1 downside to your mortgage is all that interest – you’ll pay nearly double what you agreed to pay for the home. But, no surprises here, right?

Here’s what you need to know. Your 5% LOW INTEREST mortgage is really costing you upwards of 60% or more!